The Greatest Guide To Employee Retention Credit 2020

Table of Contents5 Simple Techniques For Employee Retention Credit 2020The smart Trick of Employee Retention Credit 2020 That Nobody is Talking AboutThe Facts About Employee Retention Credit 2020 Uncovered5 Easy Facts About Employee Retention Credit 2020 ExplainedHow Employee Retention Credit 2020 can Save You Time, Stress, and Money.

Recuperation Startup Businesses are still eligible for ERTC through the end of the year. A Recuperation Start-up Business is one that began after Feb. 15, 2020 as well as, generally, had a standard of $1 million or much less in gross invoices. They can be eligible to take a credit scores of as much as $50,000 for the third and also 4th quarters of 2021.Some companies, based upon internal revenue service advice, generally do not fulfill this factor test as well as would certainly not qualify. Those taken into consideration necessary, unless they have supply of critical material/goods interfered with in manner that affects their ability to remain to operate. Organizations shuttered but able to proceed their procedures largely undamaged with telework.

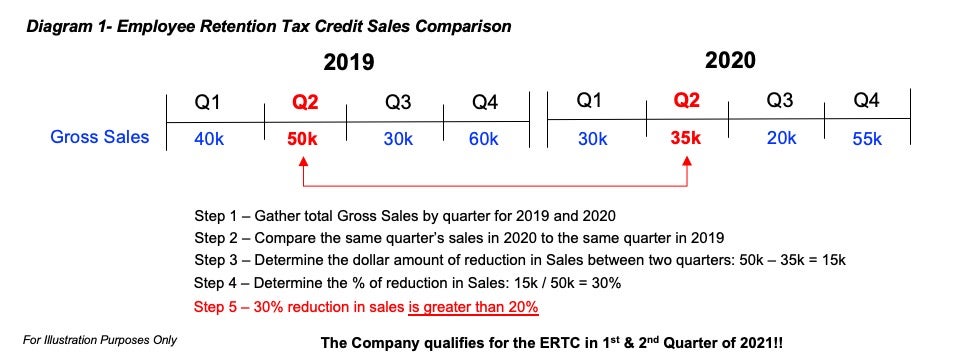

If you are a new company, the IRS permits the use of gross receipts for the quarter in which you started service as a recommendation for any kind of quarter which they do not have 2019 numbers because you were not yet in company. American Rescue Strategy Act 2021 Along with eligibility requirements under the Consolidated Appropriations Act, 2021, company also have the alternative of establishing eligibility based upon gross receipts in the right away coming before schedule quarter (compared to the matching quarter in 2019) (employee retention credit 2020).

Get This Report about Employee Retention Credit 2020

It needs to additionally be noted that figuring out if this classification applies is assessed for each quarter. So, if one of the other two groups gross invoice decline or full/partial suspension applies to third quarter yet not fourth, they would not be a recovery start-up in third quarter, yet they may still certify as a recuperation start-up in fourth quarter.

Bear in mind, the credit rating can just be handled salaries that are not forgiven or anticipated to be forgiven under PPP. When identifying the qualified health and wellness expenditures, the IRS has numerous ways of calculating relying on conditions. Normally, they include the employer and employee pretax portion and none after-tax amounts.

For the purposes of the worker retention debt, a full-time staff member is specified as one that in any kind of schedule month in 2019 functioned at the very least 30 hours each week or 130 hours in a month (this is the month-to-month matching of 30 hours weekly) and also the interpretation based upon the company shared responsibility arrangement in the ACA - employee retention credit 2020.

Basically, employers can just utilize this credit scores on employees who are not working. Companies with 100 or less full time workers can make use of all worker salaries those working, as well as whenever paid not going to collaborate with the exemption of paid leave given under the Families Initial Coronavirus Action Act - employee retention credit 2020.

The smart Trick of Employee Retention Credit 2020 That Nobody is Talking About

The IRS does have guardrails in area to avoid wage boosts that would certainly count towards the credit rating once the company is qualified for the worker retention credit score. Are Tipped Wages Included in Qualified Incomes?

Tips that total up to much less than $20 in a month are not subject FICA earnings as read the full info here well as would certainly not receive the retention credit report. Are Owner/Spouse Earnings Consisted Of in Qualified Earnings? It was well understood from a previous law and previous internal revenue service assistance that associated individuals to a bulk proprietor were not consisted of in certified earnings (see INTERNAL REVENUE SERVICE FREQUENTLY ASKED QUESTION # 59 for specifics).

If they are taken into consideration a bulk proprietor, then their earnings are not certified salaries for ERTC. Bear in mind, these regulations the IRS clarified use to all quarters for ERTC. As a result, if wages were previously miss-categorized as qualified wages for ERTC, then changes to the 941 would certainly be needed to remedy any unintended mistakes.

Employers who take the employee retention debt can not take debt on those exact same competent incomes for paid family medical leave. If an employee is consisted of for the Work Possibility Tax Credit score, they might not be consisted of for the worker retention credit history. Keep in mind, the credit scores can only be tackled salaries that are not forgiven or anticipated to be forgiven under PPP.

How Employee Retention Credit 2020 can Save You Time, Stress, and Money.

If the credit exceeds the company's overall liability of the section of Social Security or Medicare, relying on whether prior to June 30, 2021 or after in any kind of calendar quarter, the excess is reimbursed to the employer. At the end of the quarter, the quantities of these credit scores will certainly be resolved on the company's Form 941.

31, 2021 Employers (not Recuperation Startup Organization) that asked for and received an advanced settlement of the ERTC for incomes paid in the fourth quarter of 2021 will certainly be needed to repay the developments by the due date for the appropriate employment income tax return that consists of the 4th quarter of 2021.

The IRS uploaded guidance to clarify exactly how it would certainly work. If a qualified employer utilizes a PEO or CPEO, the retention credit report is reported on the PEO/CPEO aggerate Form 941 and also Arrange R. Looking forward If companies have inquiries or need even more information, they need to function with their accountant as well as pay-roll specialist.

The Main Principles Of Employee Retention Credit 2020

Your eligibility as a company is based on gross receipts of much less than 80% (versus much less than 50%) compared to the exact same quarter in 2019. This suggests if your gross receipts decline even more than 20% in 2021, you are eligible to take the credit report. You you could try these out can elect to utilize the quickly preceding calendar quarter (i.

In other words, you can count incomes paid to both energetic (working) employees as well as those not offering solutions. The CAA also gets rid of the limitation on competent salaries specified as no even more than the employee would have obtained in the thirty day before the qualifying period. Now, for instance, you can take the ERC if you pay a bonus offer to an essential worker.

This consists of seasonal companies, part-time employees, and employers not out there in 2019. Just how to Qualify as a Qualified Company Whether you qualify as an "qualified company" depends on the moment period in concern. Through from, you have to have continued a trade or business or were a tax-exempt company that: Was partially or totally put on hold because of COVID-19 orders from an ideal governmental authority, Experienced a considerable decrease in gross receipts, defined as much less than 50% of gross receipts for the same calendar quarter in 2019 Additionally: Federal government and also state entities as well as political subdivisions are not qualified for the 2020 ERC.If you were freelance, after that you are not eligible for the 2020 ERC for your very own incomes.